refinance closing costs transfer taxes

Municipal and provincial tax. Real estate taxes that were paid for by the mortgage lender.

What Are Real Estate Transfer Taxes Forbes Advisor

Including title insurance inspection fees appraisal fees and transfer taxes.

. Closing costs for sellers can reach 8 to 10 of the sale price of the home. Form 1098 a mortgage tax form you receive from your mortgage company provides only information about the mortgage interest and property taxes paid in the prior year. Primarily due to market-specific title charges and taxes.

Escrow costs for property taxes and homeowners insurance Your closing costs will vary depending on the new loan amount your credit score and. Closing costs may be rolled into the loan amount or be paid at closing depending on the loan program loan characteristics. Buyer closing costs are often 2 to 5 of the home purchase price.

Sales tax issued at closing. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Mortgage closing costs are the fees you pay when you secure a loan either when buying a property or refinancing.

185 copies. You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. Closing Costs Calculator Photo credit.

In California the average home sells for 600000 to 700000. Its higher than the buyers closing costs because the seller typically pays both the listing and buyers agents commission around 6 of the sale in total. In exchange for an available cost reduction or waiver if you pay off and close the loan within a certain period usually three years you may.

Pay on average 5749 for closing costs including taxes according to a 2019 survey from ClosingCorp a real estate closing cost data firm. This is the tax paid when the title passes from seller to buyer. Real estate taxes charged to you when you closed.

Visit to use Closing costs estimator for free. About 2-5 of the home loan amount on average. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

The District of Columbia has the highest closing costs at over 25000 with taxes. Sellers can deduct closing costs such as real estate commissions legal fees transfer taxes title policy fees and deed recording fees to lower the profit and lower the potential taxes owed. Assuming seller closing costs run 8 of the sales price including the real estate commission deductible closing costs on the rental property sold for.

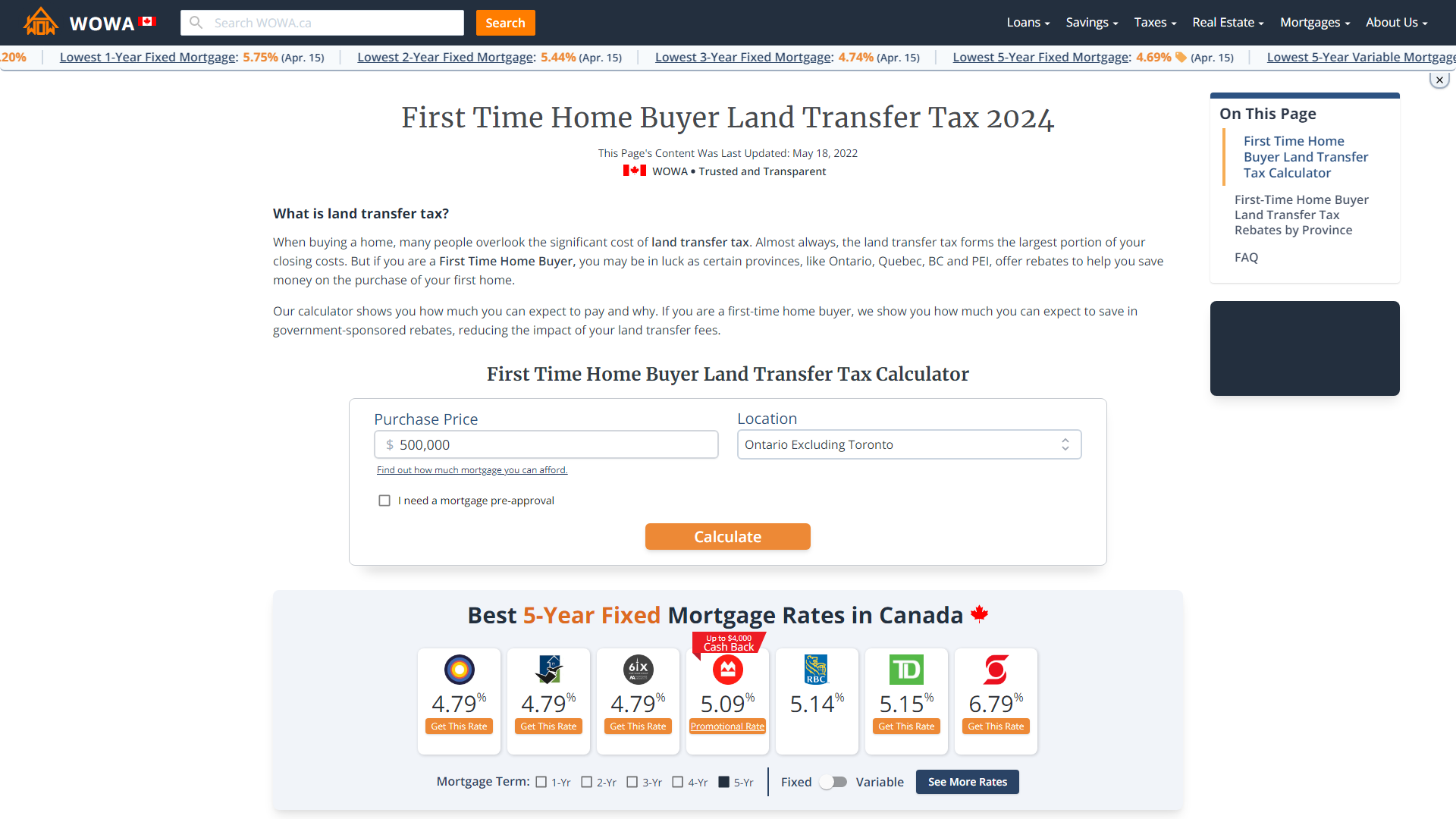

Also called Land Transfer tax property transfer tax land registration fees deed registration fee or tariff. Maryland closing costs Transfer taxes fees. Generally you can expect to pay 2 percent to 5 percent of the loan principal amount in.

The IRS denotes the following as deductible costs. USDA closing costs are generally on par with other major loan programs. On a 300000 USDA home loan you might pay around 6000 to 10000 in.

Mortgage interest paid when cost was settled. Doc Prepatty fees. The Loan term is the period of time during which a loan must be repaid.

Beware of the catch though. Best Balance Transfer Credit Cards. You can find the closing costs we outlined on page 2 of your disclosure.

The average closing costs without taxes come to 3339. If you find a property within that price range expect to pay between 6120 and 7140 before taxes in closing costs. Low closing costs and fast closing.

For eg a 480000 refinance in the Chicago market may. Youll need a copy of your closing disclosure to verify tax-deductible closing costs. Fees and taxes for the seller are an additional 2 to 4 of the sale.

Only a few eligible ones make the cut. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. Typical closing costs for a buyer of a 250000 home might range between 5000 and 12500.

Although some lenders may reduce or waive them altogether home equity loan closing costs typically range anywhere from 2 to 5 of the loan amount. How much are the average estimated closing costs for buyers. These charges cover your inspection appraisal and origination costs as well as title insurance and courier fees.

In fact we replicate an entire Loan Estimate that you would get from a potential lender for your specific area. You closing costs are not tax deductible if they are fees for services like title insurance and appraisals. You cant completely deduct all the costs of closing on your house.

Homebuyers in the US. This is a provincial or municipal tax based upon the purchase price and is calculated differently by province and. Home equity loan closing costs and fees.

Minimum of 500 plus GSTHST payable upon closing to your lawyer. The closing costs calculator is used for calculating the estimated closing costs for a purchase or refinance. Average closing costs in California.

You should expect to pay between 2 and 5 of your propertys purchase price in. For example a 30-year fixed-rate loan has a term of 30 years. Refund Transfer is an optional tax refund-related product provided by MetaBank NA Member FDIC.

Title fees insurance calculator MD Title Insurance rates Local closing attorney. The average refinance closing costs increased in 2021 to 2375 excluding taxes according to ClosingCorp.

Reducing Refinancing Expenses The New York Times

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gr Real Estate Infographic Real Estate Tips Real Estate Investing

A Guide To Closing Costs In Canada Another Loonie

Toronto Land Transfer Tax Calculator Rates Rebates

Land Transfer Tax In Ontario Ratehub Ca

6 Typical Closing Costs In Ontario Wahi

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Land Transfer Tax In Ontario Ratehub Ca

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Land Transfer Tax Calculator For Canadian Provinces 2022 Wowa Ca

What Is A Loan Estimate How To Read And What To Look For

Everything You Need To Know About Closing Costs Titlers Professional Corporation

Mortgage Closing Costs For Buyers True North Mortgage

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Mortgage Closing Costs For Buyers True North Mortgage

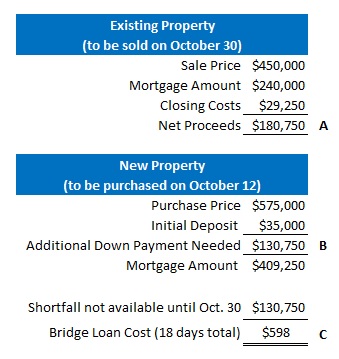

Bridge Financing A Solution When Buy And Sell Dates Don T Overlap Dave The Mortgage Broker